Market Volatility Update 3.17.2022

I wanted to share some investment thoughts in a timely manner and thought a short video might be the easiest way to do this.

We are starting to hear the concerns that many investors have, now in our 3rd month of market volatility after what was a VERY muted investment experience in 2021. You can’t avoid the headlines; its Russia-Ukraine, it’s inflation, it’s the Federal Reserve and interest rates, supply chain issues and now Covid cases rising overseas again. It’s heavy and the news is very good about making sure you see and hear ALL of it.

I’ll do my best to share some context but as always, we welcome your calls and are happy to schedule meetings.

- Experiencing a period of losses is never comfortable, but remember, you’ve been here before. We’re not too far removed from the market drop at the onset of covid-19 in March of 2020, the 20% (almost) bear market at the end of 2018, or the near 20% correction at the beginning of 20161. You’ve been through volatility before and it never feels good, but the market has always recovered to new all-time highs. Patience is key to let the market digest things and course correct. TIME HORIZON MATTERS

- Diversification matters. How much do you have in stocks? How much in bonds? What kind of stocks do you own? What kind of bonds? Where we are today? The Dow down roughly 8%, S&P 500 down 10%, and the Nasdaq 17%2. Even bonds (the AGG index as a benchmark) is down almost 5.5%. Think about that; Dow Jones stock and AGG bond index roughly down the same amount? This market may feel worse for conservative investors because that illustrates that there really isn’t anywhere to hide. MORE ON INTEREST RATES IN A SECOND

- Third, we hit all-time highs on 1/3 (just 10 weeks ago) and by January 27th, the S&P500 was almost down 10% already for the year2. That was a quick move for the market. Think about what that means relative to the Russian invasion of Ukraine which began a month later on February 24th. The S&P500 is actually positive since Russia invaded Ukraine2. I think that’s extremely telling because it reminds us that WHAT THE MARKETS REACT TO MATTERS – AND THAT THE MARKET IS ALWAYS FORWARD LOOKING

- The January market downturn can in part be attributed to anticipated Federal Reserve rate hikes – well before they ACTUALLY started today.

- The January market downturn occurred BEFORE the actual fighting started

- Doesn’t mean there won’t be pivots, but this is why you hear the term “the market has already priced this in”

- By the time you read the headline, you’re too late to trade

All that context aside, ultimately, I think the question many of you are asking is where do we go from here? The hard part in all of this is isolating market moving inputs; how much of this is inflation and the Federal Reserve’s commitment to raising interest rates? How much of this is MORE supply chain disruption from the conflict, from Covid causing more Chinese factory shutdowns? From oil prices surging?

I’ll address “where do we go from here” in two parts. The first is to look backwards into history to try to gauge how the market has reacted to similar situations in the past.

- Could rising rates and inflation and supply chain issues be enough to push us into a recession? Sure. But remember that the definition of a recession is decline in economic activity for 2 consecutive quarters. Economic term, not a market term. Markets move down before recessions and move back up prior to being “out” of a recession.

- Moves tend to be sharp

- If your time frame is long enough and you follow 3 bucket theory, does any of this really matter 3-5 years from now? No

- In fact, if you’re a buyer, it could be good!

- Don’t be scared of that word recession

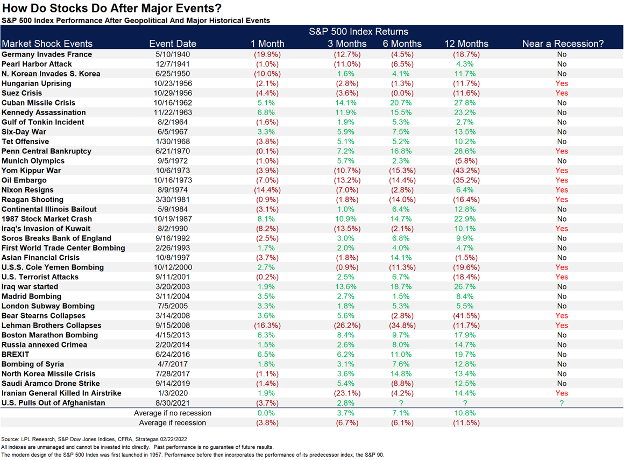

- Could we be in for a bear market (20%)? Sure. But remember, that’s not abnormal, especially as part of market shock events. Think wars, conflicts, geopolitical events, things that were part of natural economic cycles. Historically – after-market shock events, the stock market is actually higher after 3 and 6 months and 10% higher a year later if not near a recession3

- Historically – if near a recession, losses on average are ~6% after 3 and 6 months and 11% after 12 months (we’re close to that 11% already)3

All of that is to say, history suggests that our recent experience is very normal and after a bit of time, the market regains its footing.

The second answer to “where do we go from here” or “what are we going to do about it” would be to reiterate our investment philosophies.

- We are diversified so that your experience will not perfectly match the experience you see in the headlines and on the news

- We don’t typically make large changes based on the market, we make changes based on your life, so as long as your needs and goals haven’t dramatically changed in the last 10 weeks, we feel that you will be ok.

- We build portfolios based on the history of the markets, we know they go up and go down. The math we used to build the portfolio incorporated really scary markets like this and it also incorporated really good markets like we had in 2019 and 2020 and 2021. We knew losses would happen again, but we didn’t know when and we didn’t know why and we didn’t know how bad, but that’s ok. We were prepared.

- Given everything that’s still to be digested by the market and the fact that your goals haven’t changed, I know it’s somewhat unsatisfactory, I know emotionally it’s not what some may want to hear, but I can’t think if any better advice than we stay the course. As of today, that’s what we plan to do.

- The lesson is to avoid trying to time things, letting our guts or our politics or our worries about anything get in the way of staying invested and staying diversified.

I hope that context helpful. If you have individual questions, let's be sure to spend some time together. Thanks.

- Source: Bloomberg, 4/29/1942 - 12/31/2021. Past performance is no guarantee of future results. For illustrative purposes only and not indicative of any actual investment. Investors cannot invest directly in an index.

- Source: Bloomberg, 1/1/2022 – 3/16/2022. Past performance is no guarantee of future results. For illustrative purposes only and not indicative of any actual investment. Investors cannot invest directly in an index.

- https://i0.wp.com/lplresearch.com/wp-content/uploads/2022/02/2.24.22-Blog-Chart-3.png?ssl=1

Investment advice offered by Great Valley Advisor Group, a registered investment advisor.

Tracking # T003742