Ep #1: What Is Financial Planning Anyway?

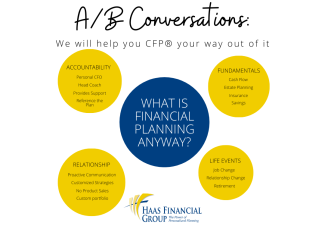

Welcome to A/B Conversations: We Will Help You CFP® Your Way Out Of It, a podcast where you get into the minds of a couple Certified Financial Planners™ on how we think about everyday financial planning questions and what should really matter most to you. Over the last few months the world, our lives and in some cases what we value most, have changed. It's leaving us with more questions than answers. Each week, we'll discuss what's on our mind about the financial topics you care about most.

In this opening episode, Adam and Ben talk about what they do as Financial Planners and break down how we can work for you and help you plan for your future financial goals. Listen in to learn about the fundamentals of the process and key life events that may trigger the need for financial planning help.

You can also watch the full video on YouTube:

Benjamin Haas 00:03

Hi everyone and welcome to A/B Conversations, where we will help you CFP your way out of it. A podcast where you get into the minds of Certified Financial Planners on how we think and feel about everyday financial planning questions and what should really matter most to you. A healthier financial life starts...now! So I thought, in our podcast, we start with what I feel is like the most obvious and most frequent question we get not always in the office when we meet someone for the first time, clearly, this would be the question. I'm talking more, we're out in the community, we're with friends and family, you're out at the race track. I'm sure you get this question a lot too and it's that "What do you really do"? Said differently "What is financial planning anyway"? I think we got a lot of jargon in this industry; you and I can certainly talk about things that we would say it definitely isn't. Let me pose that question to you. What is financial planning anyway?

Adam Werner 01:19

It's not always that easy to put in a box because it does mean different things to different people. Oftentimes at least from our standpoint, it's depending on the life event or the stage of life that someone is at, the planning process, the step-by-step process may be easily replicated. The process doesn't necessarily change but the topics, the strategies, or the areas of focus, certainly change depending on the life stage that somebody is at.

Benjamin Haas 01:54

Let's break that part down. When I think of financial planning in four different ways and you're hitting on probably the first one. We talk about it as a very comprehensive process. People may call themselves financial planners but maybe that's just something that leads to asset allocation or something that leads to an insurance product or something like that. When we talk about financial planning, you said process, we call it a very comprehensive thing. We call it checking a bunch of boxes. What are those boxes? How would you articulate what somebody is actually going to get out of what questions are going to be answered out of the financial planning process?

Adam Werner 02:40

There's certainly as part of that standard process, put aside different stage of life, different life event, whatever they're going through, loss of a spouse, retirement, any of those things. There's always going to be what we call the fundamentals and it's just an analysis on cash flow. Do they have the right amount of cash reserve? Are they saving in the right vehicles? Do they have the right amounts and right types of insurance that that they need? Do they have an estate plan in place, and even that's just as basic as Will, power of attorney, living will. Just the basic building blocks before you can even get into the specific fires that need to be put out, whether that is someone's retiring in a couple of years and they want to make sure that they have the assets to do that.

Benjamin Haas 03:31

That's cool because you hit on the second thing that I would have wanted to hit on and that is here's what you're going to get out of it this comprehensive process: accountability. We're going to be your partners, we're going to make sure that there aren't any potholes that you didn't know about. Nothing bad coming around the corner. I think people find what we would deem financial planning is the questions that are specific to a life event or something big that comes their way. You hit on that, whether it's the big things, loss of a job. How many people are going through that right now? A career change or promotion? It may be a relationship that has changed, whether it's because something didn't work out, God forbid the loss of a spouse, family events, all the way down to I think the most common one. People find us around retirement when they go, "Oh, crap, I got all these questions to answer" and the big daunting things of "Am I going to have enough"? How am I going to cover healthcare, I'm going to recreate paychecks. I think you hit on the second one. It's a comprehensive process, checking a lot of boxes, the same thing for everyone in that point, but life transitions and life events would have been the second one. I also want to hit on I would think, as we would want to articulate it that financial planning is a relationship. It's the "well, I got a guy, he takes care of that". So maybe give me your perspective on that. When we say hey, what do we do? We work intimately with families on financial planning, what is the relationship actually look like?

Adam Werner 05:07

That's a good question. Part of that process going back to the process itself, it involves a lot of conversation in trying to get to the heart of what someone's values actually are. Going through the financial side of things, it's all the basics from a financial standpoint but that doesn't necessarily tell the whole story when now we're trying to put that together with how do they actually think and feel and act with their money to get to that ultimate goal, whatever that goal may be and just trying to make those things actually fit together. You can tell pretty quickly by what someone has accumulated or what they're actually doing, beyond just what they say, kind of their goal is.

Benjamin Haas 06:00

I think that's a really key point because once we kind of put all of that together and we kind of understand what they value, how they think what matters to them. That is a great precursor in a great foundation for when they actually do go through some sort of life transition because then you've got that backbone of not only feeling like, hey, I've got this team supporting me to help me answer these questions when the variables change but I've already got that plan in place that doesn't feel like I'm having to start all over. Think about how stressful the situation must have been for people that have a huge life event, like a once in a lifetime pandemic, right now having to like completely change something versus somebody that had a plan in place. Had that lifeboat that we want a financial plan to be that kind that says, Hey, we knew storms are going to come, we didn't know when or how, certainly nobody may have predicted this being the reason or the occurrence. Luckily, you've got that foundation that keeps things on an even keel may mean that we have to steer the ship a little bit but it's not building a ship in the middle of a storm. I like to think of financial planning on the fluffier side, as the relationship, being able to say, I got a guy. Okay, so the fourth thing that I had on my mind, and would want you to weigh in on this. The misconceptions? Sometimes it may be easier to articulate financial planning as what it isn't. We've been doing this long enough together, we've seen those misconceptions, maybe throw some of them out there.

Adam Werner 07:40

So I don't want to throw these people under the bus but it's an insurance agent who clearly looks at one specific focus. We look at comprehensive planning, we're trying to see your whole financial picture and put all those puzzle pieces together. What it isn't is a product sale. There's no end goal, there's no Happy Meal here at the end of the process that says, You get to choose between solutions, A, B, and C. It's way more open ended. It's all customized to the actual strategies that will work.

Benjamin Haas 08:18

I like that one. I'd also say it's the same kind of idea of what it isn't. It's not a cookie cutter portfolio. I know, there's many different ways to invest in certainly we see that we are independent financial advisors. We get to think about it from different ways but it is certainly not, hey, here are two financial planners, two CFP's. I want to invest the money so I'll go to them. For us financial planning is I don't know how to do that effectively for you before we go through this process. That in some way dictates to me how you should be invested. It's not to tell you how to think and feel about investments. It's what are we working towards so that we're picking the right vehicles. We're picking the right instruments, we're managing that the most important way so we certainly manage money but that is after a comprehensive financial planning process that takes place.

Adam Werner 09:19

We've certainly been around long enough to know that when you start a relationship off purely looking at investments, that's not necessarily a bad thing. But it's hard for us to always answer the question of where they should be allocated. Again, it comes back to goals and their values. It's, if there is a specific goal in mind that's not always the end all be all in terms of, then how should you be invested? Then really, is that entire picture that needs to come together and investments are certainly a part of that.

Benjamin Haas 09:52

I'd button that up by also talking about that investment standpoint, once that plan is put in place, I don't want the misconception out there either to be that there isn't a very proactive level of communication that needs to come with that. To think about what we just went through, a horrible market downturn in March, to see that turn around pretty quickly. The whole point of the financial plan is, maybe we'll do a podcast on this next time, is to provide that life boat that says, we have a plan that has dictated how we should be invested in good times and bad, and then have a proactive process for making sure you're on top of that when things need to be tweaked. We certainly would not say any financial planner that truly does financial planning, are acting like brokers buying and selling every day? That's not financial planning.

Adam Werner 10:45

Maybe we touched on this a little bit earlier but in your words, we often like to think, what's in it for them? What does someone get out of this process? Back to your point of, what is this process not? What is financial planning not. What does somebody get out of the process by actually going through our planning process with us?

Benjamin Haas 11:07

That's where, you would say, it depends. How do people digest things. Part of being what I would call a boutique practice that has very in-depth relationships with clients is that to some people, that's a one-page sheet of, "here are the next steps of what we have to do, who's going to do it, and by when". For other people, that's a 15-page document that says, here's all the things you're trying to accomplish. Here's what we saw that's not going well, here's what we need to change and why, here's how we're going to go about doing it. Then here are the 13 reports that are going to go with it to support why we're thinking this way. I think what people get out of it, either way, is another set of eyes. It's an accountability partner in many ways. We're a CFO for busy people so they don't have to be on top of everything all the time. We like to call it head coach, somebody that's going to bring together their other professionals but all the while it's financial planning as an accountability partner to help to get to where you want to get to.

Adam Werner 12:08

We know ultimately, the best advice, the most perfect strategy that you can write somebody or tell them here's what you need to do. It's worthless if it doesn't actually get implemented and put into practice.

Benjamin Haas 12:20

I like it. All right.

Adam Werner 12:22

Okay. Do we need to let people in on the the A/B Conversations so you can see your way out of it?

Benjamin Haas 12:29

There we go. Hey everyone, Adam and I really appreciate you tuning in. Please note that the opinions we voiced in the show are for general information only and are not intended to provide specific recommendations for an individual. To determine which strategies or investments may be most appropriate for you, consult with your attorney, your accountant and financial advisor or tax advisor prior to making any decisions or investing. Thanks for listening!

Tracking # 1-05042958